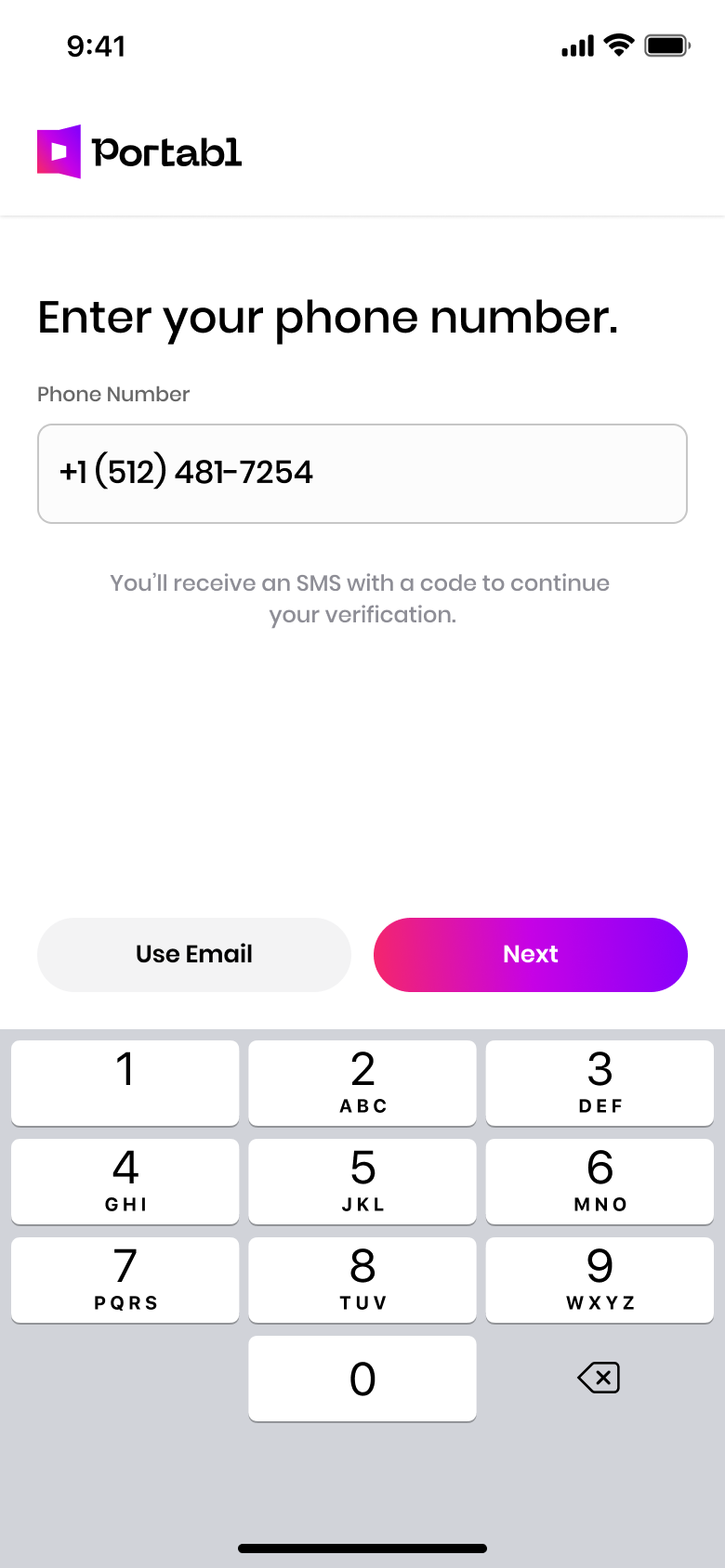

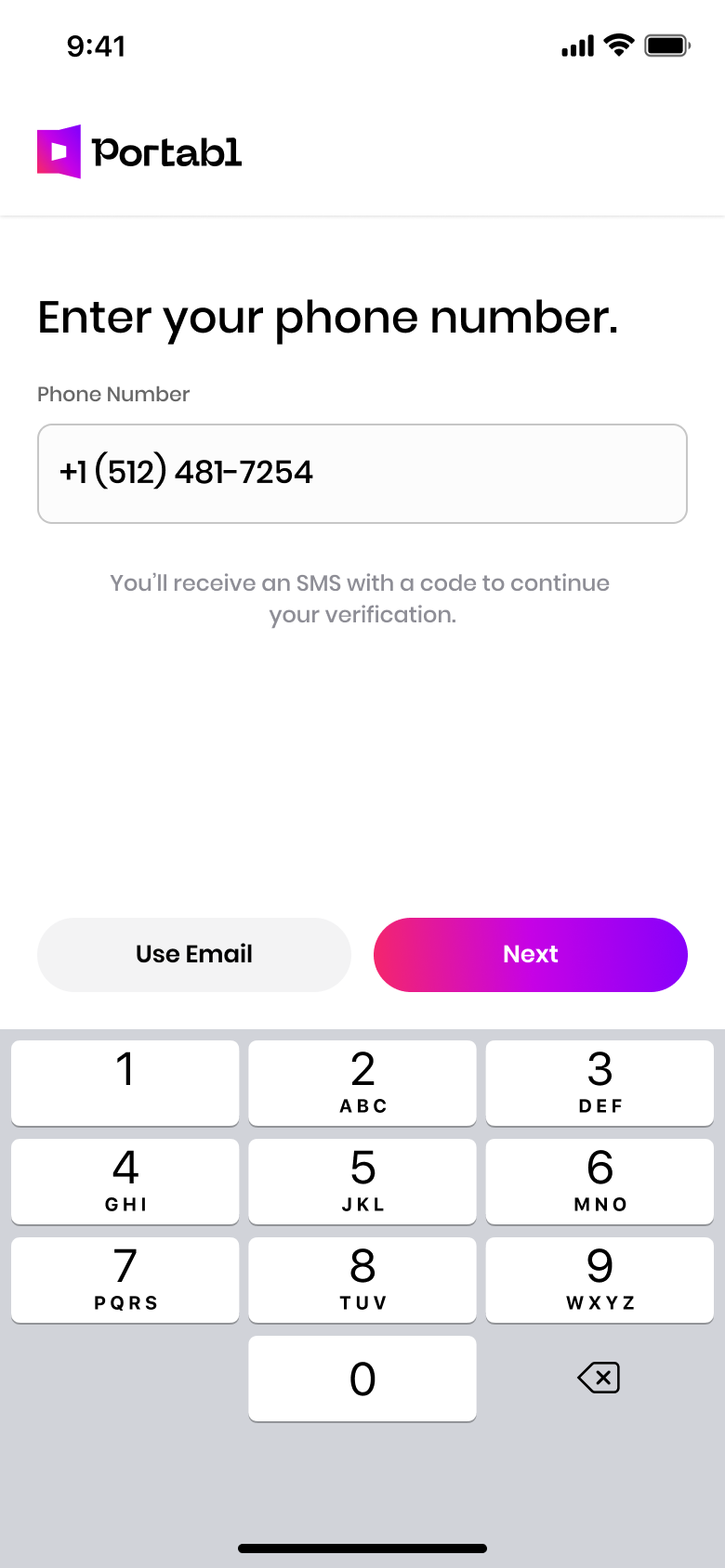

Verify more in less time

Onboard users in 2 steps and less than 15 seconds using the configurations that work best for your business.

What’s under the hood?

Verify more in less time

Onboard users in 2 steps and less than 15 seconds using the configurations that work best for your business.

Plug into your favorite flows

Get up and running in minutes with our APIs and SDKs for web and mobile.

Zero Knowledge? Zero Problem

Validate and verify information with an added layer of security by using zero-knowledge proofs (ZKPs) in place of explicit data.

Passwordless auth made easy

Use globally-recognized standards (OIDC SIOP) to let your users log in with their verified identity over an encrypted channel, eliminating password risk.

Stream your updates and audit events

Access changes in your customer data as they happen, supported by a tamper-resistent audit ledger. Simplify audit logs once and for all.

Stress-free PII protection

Each user is backed by a permissioned & encrypted cloud wallet by default—Portabl protects the most sensitive data so you can focus on your business.

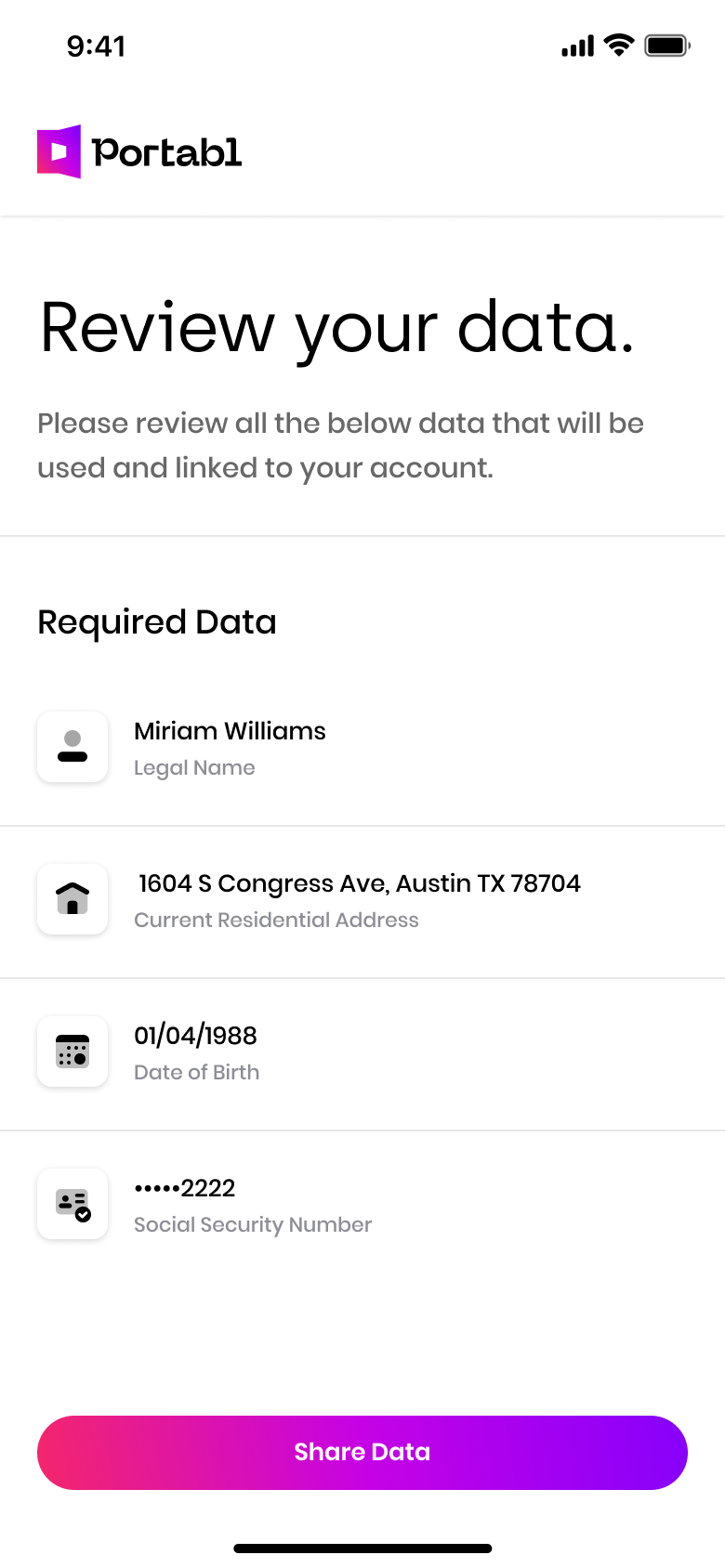

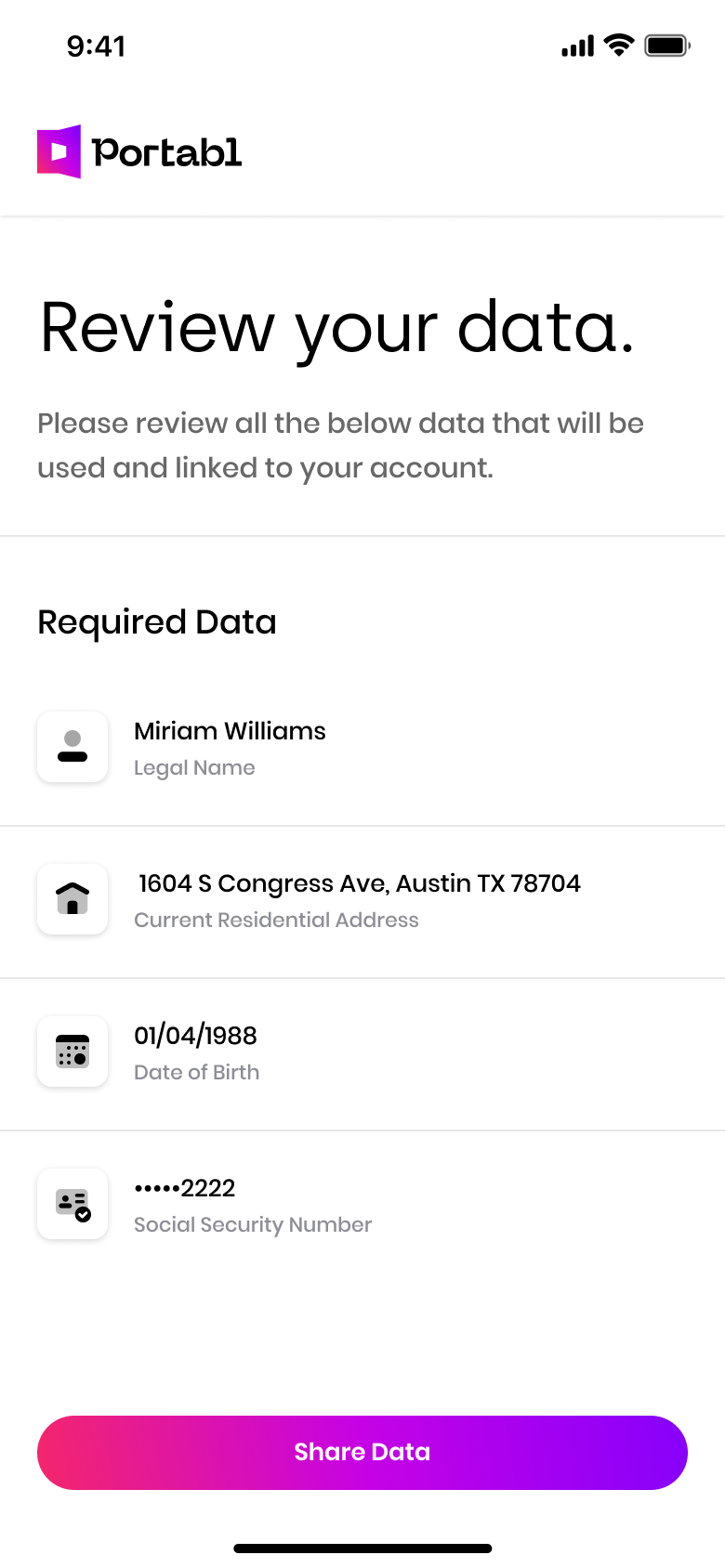

Consumers know and love single sign on solutions—they can boost customer conversion by over 20%.

Integrate Portabl’s Verifiable Credentials engine to allow people to bring their trusted identity with them to the onboarding process, recuding customer activation to seconds.

Did you know that on average, it takes 14 screens and 29 clicks to collect 16 data points when trying to enroll a new customer?

How does enrollment in 2 screens and 2 clicks sound?

Make it crystal clear what information your business is validating and enable your users to give you the 👍. By supporting mutual authentication, you protect against attacks before they happen, and set a new standard for security expetations between you and your users.

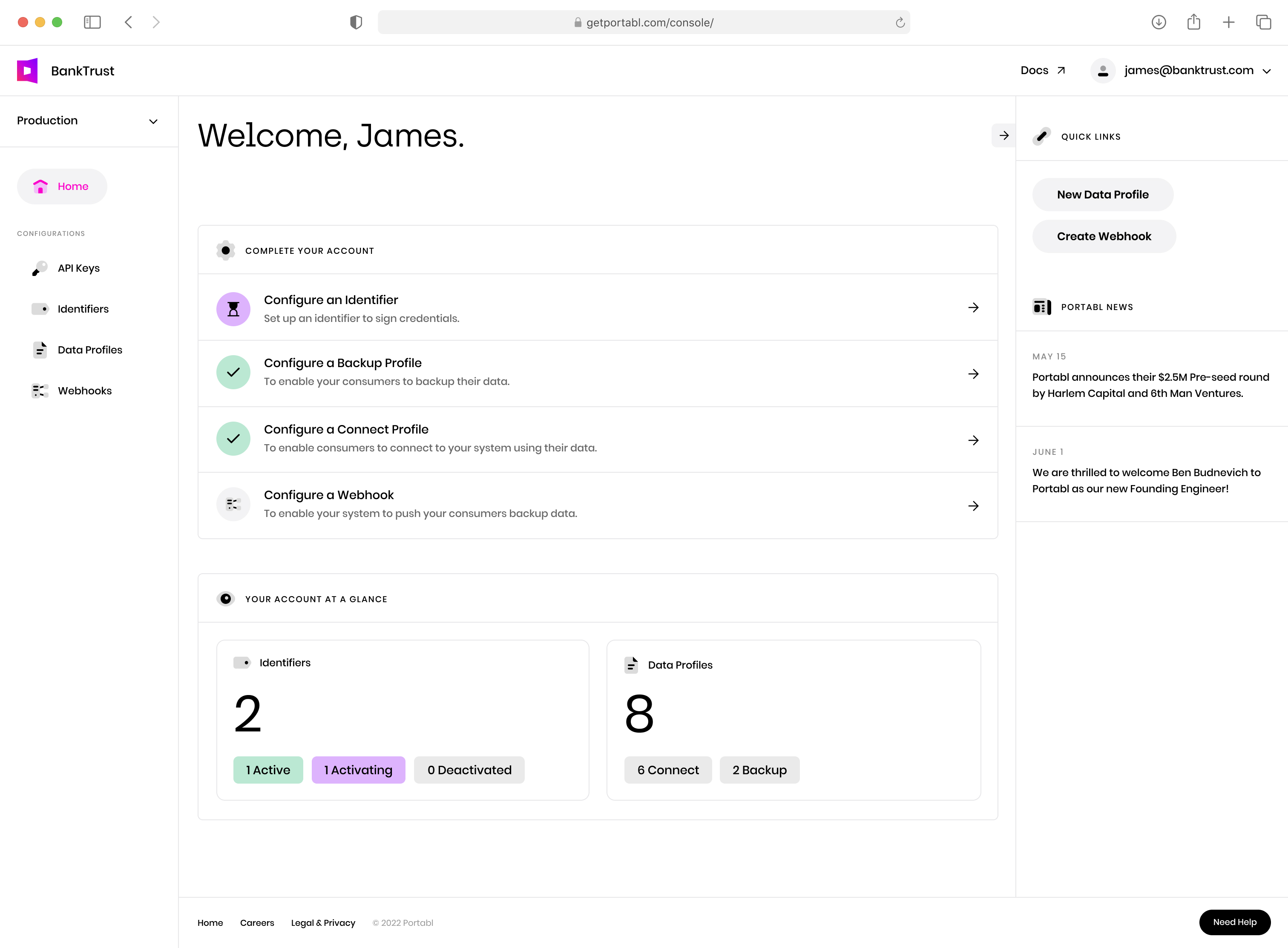

Use Portabl’s APIs and web-based tools to configure and manage everything you need to define, issue, and verifiy trusted financial identities for your users. Verification configurations make it easy to ensure that onboarding and authentication events meet your KYC standards while being data-minimizing and privacy-preserving.

Build trust with your users by issuing and verifying financial identities that grow with their needs while simplifying your most sensitive PII needs.

Let’s face it: identity is complicated, and financial identity is the most sensitive piece of the customer-provider relationship.

Thing is, establishing trust isn’t just about a smooth onboarding experience. Trusted identity needs to be maintained and continually re-verified over the life of the customer.

Portabl supports continuous re-verification based on a consent-and-event model.

Whenever your users update information over time, you can immediately verify and log the changes, and post back acknowledgement to your users.

Portabl constructs secure, tamper-proof audit logs automatically so you can focus on keeping your customers happy. Tap into data and verification histories with a single API.

Eliminate the guesswork of what data was validated, when, and the results—no manual data gathering, no missing files, and no gaps with meeting regulatory obligations.

Updated yesterday on Consumer 46284

Updated 4 months ago on Consumer 46284

Updated 8 months ago on Consumer 46284

Updated 8 months ago on Consumer 46284

Updated 9 months ago on Consumer 46284

Updated 9 months ago on Consumer 46284

Portable financial identity is the next step in open finance—access the most critical emerging competitive advantage by enabling your users to control their verified data and how it is shared it among their favorite with financial apps and services. Portabl aligns its identity standards to shared principles of the Financial Data Exchange (FDX) and Consumer Financial Protection Bureau (CFPB).

Control

Consumers have the right to access their financial data but must explicitly consent to how the data will be shared and used.

Security

Data must remain secure at all parts of the ecosystem.

Durability

Infrastructure must consistently provide consumers access to all of their information in a fast and seamless manner.

Transparency

All parties involved in data access should have transparency into consumer and ecosystem behavior.

Data Minimization

Consumers should share the least amount of data needed to still power their use case with the apps and services they want to use.

“Audit logs cost us time and money. Why can’t I have a single unbroken history for my users’ data?”

“The dream is enabling customers to act like APIs of themselves, so we can trust them and they can trust us.”

“Accessing crypto feels confusing. I just want to use my identity like a passport and do what I want.”

“I’m tired of filling in the same data over and over again. Other apps know I’m a good user and a real person, so I should just be able to bring that with me.”

🇺🇦 Portabl stands with Ukraine. Donate.